When it comes to borrowing or lending money, having a written agreement in place is crucial to avoid any misunderstandings or disputes in the future. A loan agreement outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any other pertinent details. While you can hire a lawyer to draft a loan agreement for you, there are also printable templates available online that you can use for free.

Printable loan agreement templates are a convenient and cost-effective way to create a legally binding document for your loan transactions. These templates are easy to customize to suit your specific needs and can save you time and money compared to hiring a professional to draft a loan agreement from scratch. Whether you are lending money to a friend or family member, or borrowing from a financial institution, having a written agreement in place is always a good idea.

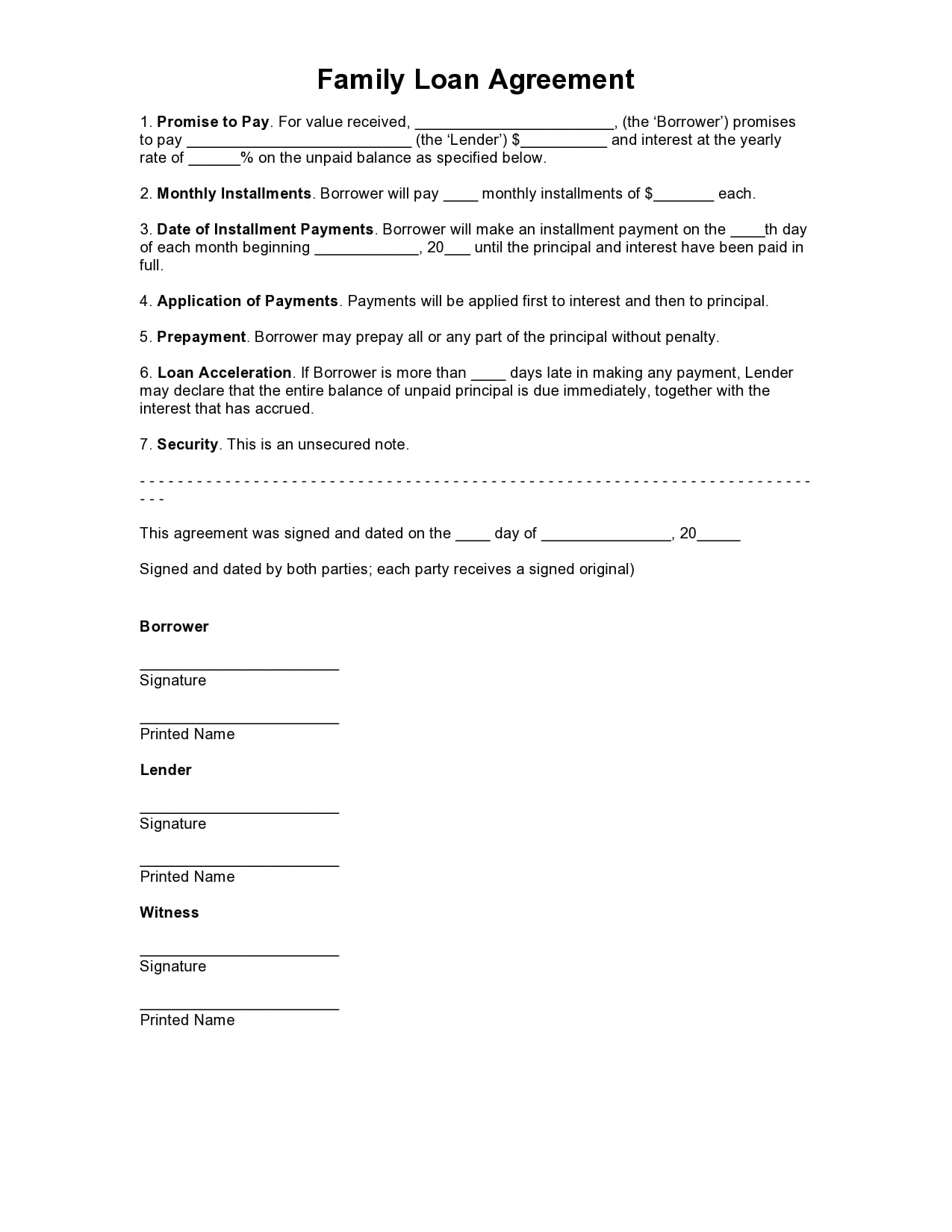

Printable Loan Agreement Template

Printable Loan Agreement Template

Using a printable loan agreement template can help ensure that all parties involved are on the same page and understand their rights and obligations. The template will typically include sections for the borrower’s and lender’s information, loan amount, interest rate, repayment terms, and any collateral that may be required. By filling in the blanks and signing the agreement, both parties are legally bound to adhere to the terms outlined in the document.

It is important to carefully review the loan agreement template before signing to make sure that all the terms are accurate and acceptable to both parties. If you have any questions or concerns about the terms of the agreement, it is advisable to seek legal advice before proceeding. Once the agreement is signed, both parties should keep a copy for their records and refer to it if any issues arise during the loan repayment process.

In conclusion, using a printable loan agreement template is a simple and effective way to formalize your loan transactions and protect your interests. Whether you are lending or borrowing money, having a written agreement in place can help prevent disputes and ensure that both parties are clear on their responsibilities. By taking the time to use a template and customize it to fit your needs, you can create a legally binding document that will give you peace of mind throughout the loan process.