Are you in need of a personal loan and want to make sure all the terms and conditions are clearly outlined? Look no further than a Personal Loan Agreement Printable. This document is a legally binding contract between a lender and a borrower that specifies the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant details. By having a written agreement in place, both parties can protect their interests and avoid any misunderstandings in the future.

With a Personal Loan Agreement Printable, you can easily customize the document to suit your specific needs. Whether you are lending money to a friend or family member, or borrowing funds from a financial institution, having a written agreement in place can help ensure that everyone is on the same page. By clearly outlining the terms of the loan, you can avoid any confusion or disputes down the line.

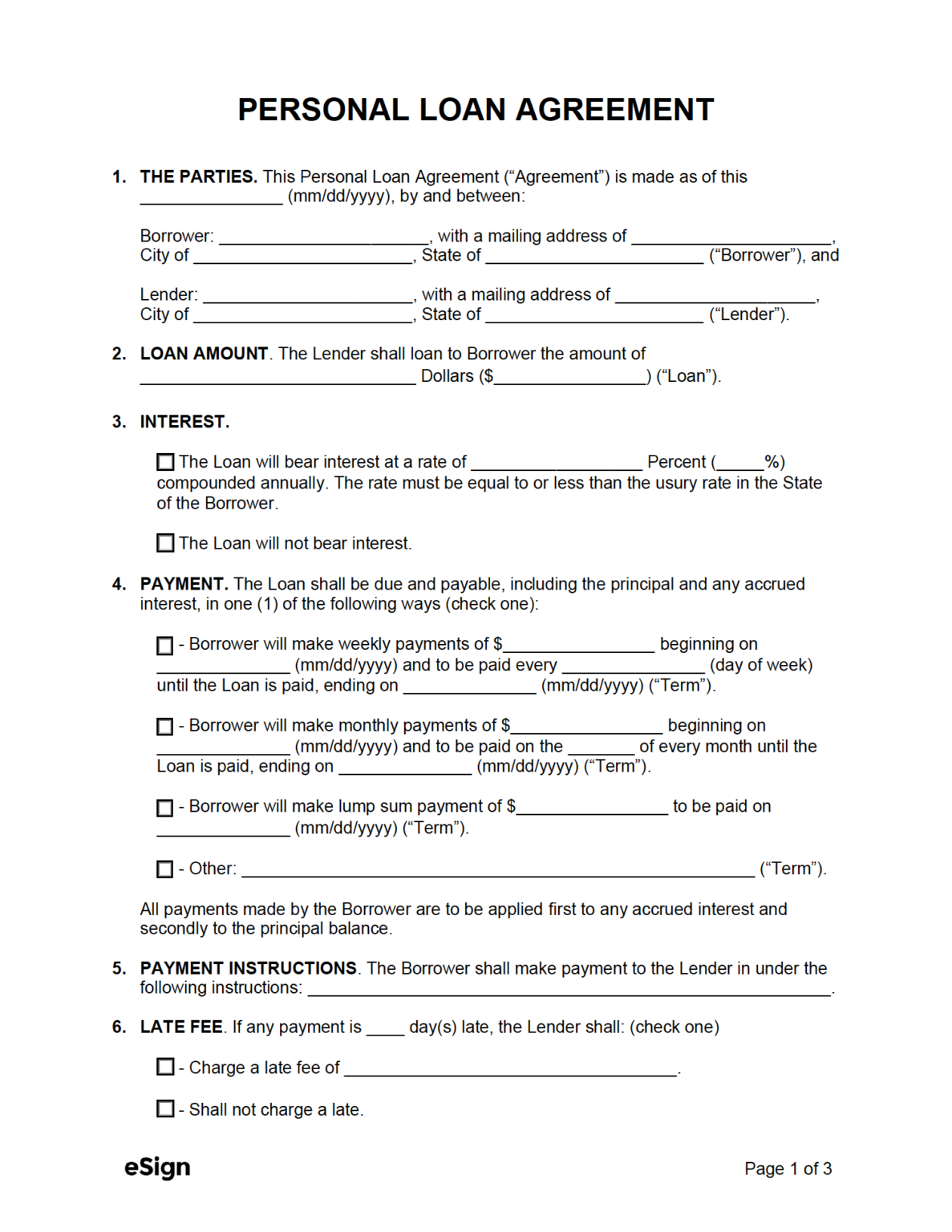

Personal Loan Agreement Printable

Personal Loan Agreement Printable

When creating a Personal Loan Agreement Printable, it is important to include all the necessary details to protect both parties. This includes the loan amount, interest rate, repayment schedule, late payment fees, and any other relevant terms. By clearly outlining these details in writing, both the lender and borrower can have peace of mind knowing that they are in agreement on all aspects of the loan.

Having a Personal Loan Agreement Printable can also provide a sense of security for both parties. By having a written contract in place, both the lender and borrower can refer back to the agreement if any issues arise during the repayment period. This can help prevent any misunderstandings or disagreements and ensure that the loan is repaid in a timely manner.

In conclusion, a Personal Loan Agreement Printable is a valuable tool for anyone looking to borrow or lend money. By clearly outlining the terms of the loan in writing, both parties can protect their interests and avoid any potential disputes. Whether you are borrowing money from a financial institution or lending funds to a friend, having a written agreement in place can provide peace of mind and ensure a smooth repayment process.