When entering into a loan agreement, it is important to have all the terms and conditions in writing to protect both the lender and the borrower. A simple loan agreement form can help make the process easier and ensure that all parties are on the same page.

Whether you are lending money to a friend or family member, or borrowing from a financial institution, having a written agreement can help prevent misunderstandings and disputes down the line. A simple loan agreement form outlines the loan amount, interest rate, repayment terms, and any other conditions of the loan.

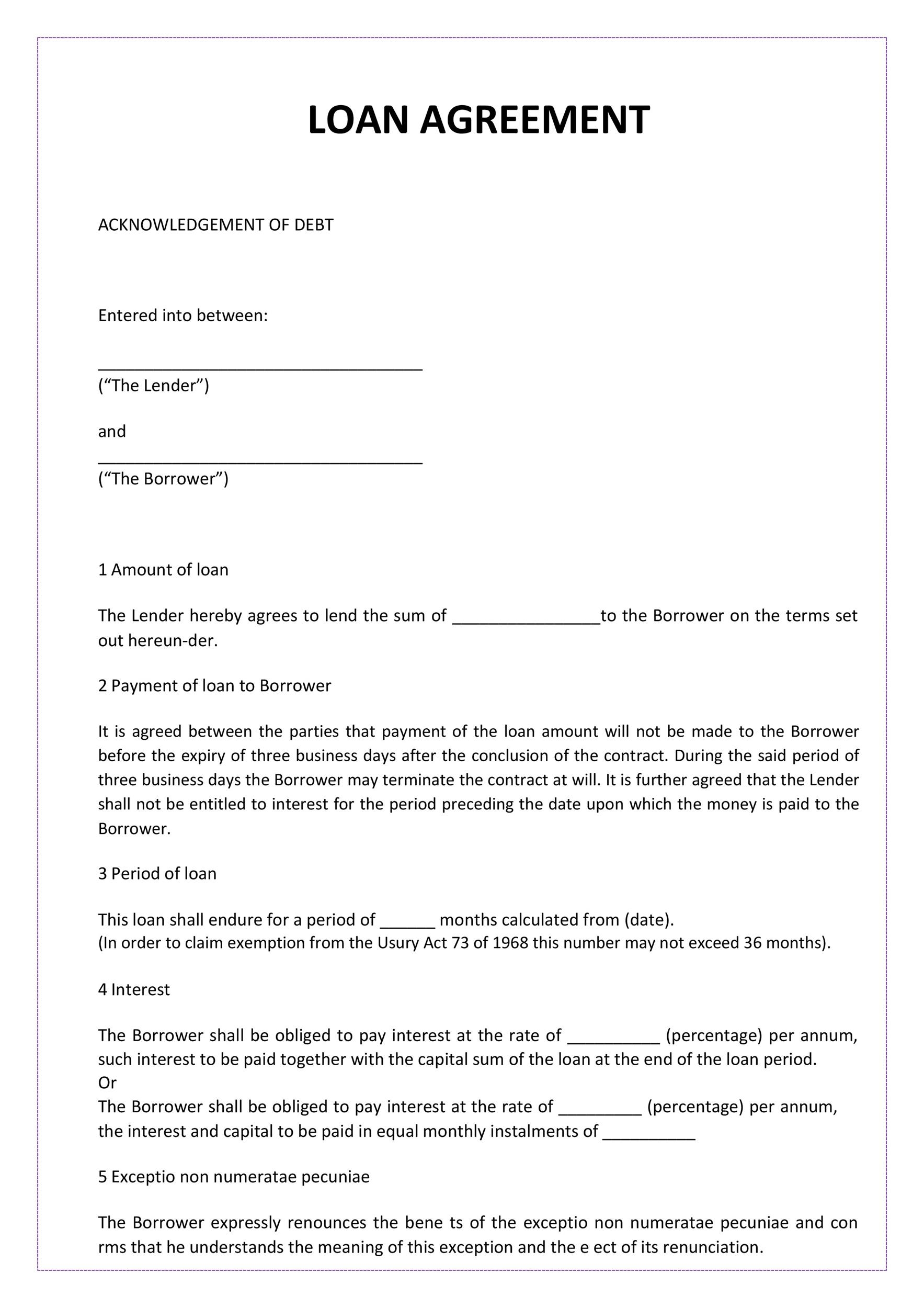

Printable Simple Loan Agreement Form

Printable Simple Loan Agreement Form

Here are some key elements that should be included in a printable simple loan agreement form:

1. Loan Amount: Clearly state the amount of money being loaned to the borrower.

2. Interest Rate: Specify the interest rate that will be applied to the loan, if any.

3. Repayment Terms: Outline how the borrower will repay the loan, including the frequency of payments and the total repayment amount.

4. Late Payment Fees: Include any fees that will be charged if the borrower fails to make a payment on time.

5. Signatures: Both the lender and the borrower should sign the agreement to indicate their acceptance of the terms.

A simple loan agreement form can be easily found online and customized to fit your specific needs. Having a written agreement can provide peace of mind and clarity for all parties involved in the loan transaction.

In conclusion, a printable simple loan agreement form is a valuable tool for documenting the terms of a loan and protecting the interests of both the lender and the borrower. By including key elements such as the loan amount, interest rate, repayment terms, and signatures, you can ensure that the loan agreement is clear and enforceable. Whether you are lending money to a friend or borrowing from a financial institution, having a written agreement in place can help prevent misunderstandings and disputes.