When it comes to borrowing money from friends or family, it’s important to have a clear agreement in place to avoid any misunderstandings or conflicts. A printable personal loan agreement can help both parties outline the terms and conditions of the loan, including the amount borrowed, interest rate (if applicable), repayment schedule, and any consequences for defaulting on the loan.

By having a written agreement, both the borrower and lender can feel more confident and secure in their financial arrangement. It provides a sense of formality and professionalism, even in a personal setting, and helps protect both parties’ interests.

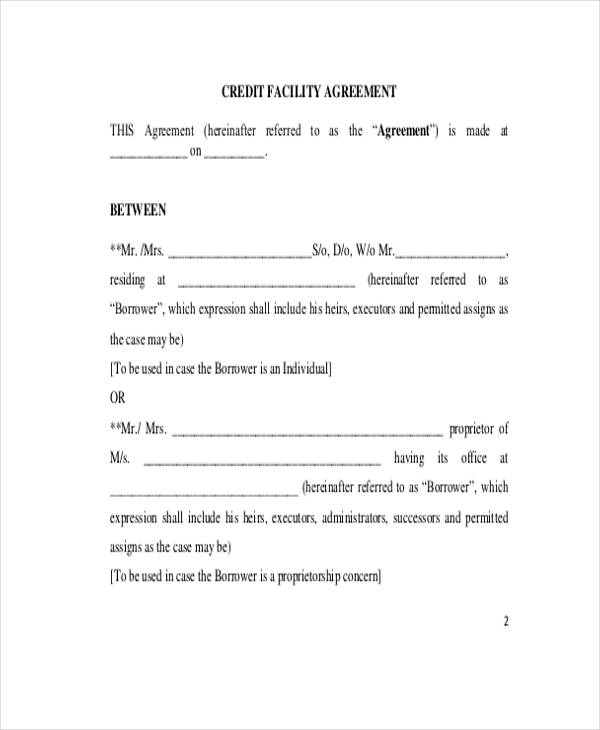

Printable Personal Loan Agreement

Printable Personal Loan Agreement

When creating a printable personal loan agreement, it’s important to include all relevant details to ensure clarity and prevent any disputes in the future. The agreement should clearly state the names of the borrower and lender, the loan amount, the repayment schedule (including due dates and amounts), any interest rate or fees, and any collateral or guarantees provided.

Additionally, the agreement should outline what actions will be taken in the event of non-payment, such as late fees, collection efforts, or legal recourse. It’s also a good idea to include a provision for early repayment, if the borrower wishes to pay off the loan ahead of schedule.

Both parties should carefully review the agreement before signing, to ensure that they fully understand and agree to the terms. Once signed, each party should keep a copy of the agreement for their records, in case any issues arise in the future.

In conclusion, a printable personal loan agreement is a valuable tool for formalizing a financial arrangement between friends or family members. By clearly outlining the terms and conditions of the loan, both parties can feel more secure and confident in their agreement. It’s a simple yet effective way to protect everyone involved and ensure a smooth and successful lending process.