When borrowing or lending money from friends or family members, it’s essential to have a written agreement in place to protect both parties involved. A personal loan agreement outlines the terms and conditions of the loan, including the amount borrowed, interest rate (if any), repayment schedule, and any collateral provided.

While hiring a lawyer to draft a loan agreement can be costly, there are free printable templates available online that can be easily customized to suit your needs. These templates provide a convenient and cost-effective solution for creating a legally binding agreement.

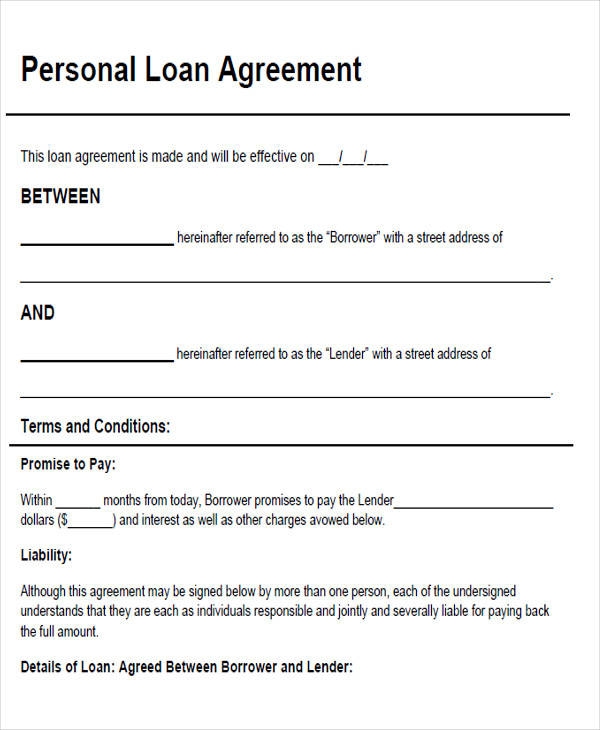

Free Printable Personal Loan Agreement

Free Printable Personal Loan Agreement

Benefits of Using a Free Printable Personal Loan Agreement

1. Legal Protection: By having a written agreement in place, both the borrower and lender are protected in case of disputes or misunderstandings. The agreement clearly outlines the terms of the loan, reducing the likelihood of disagreements.

2. Clarity: A loan agreement helps to establish clear expectations for both parties involved. It specifies the repayment schedule, interest rate, and any other relevant terms, ensuring that both parties are on the same page.

3. Customizable: Free printable loan agreement templates can be easily customized to suit your specific needs. You can add or remove clauses, adjust the repayment schedule, or include any other terms that are important to you.

4. Convenience: Using a printable template saves time and effort compared to drafting an agreement from scratch. Simply fill in the necessary information, print out the document, and have both parties sign it to make it legally binding.

5. Cost-effective: Hiring a lawyer to draft a loan agreement can be expensive, especially for small loans between friends or family members. Free printable templates provide a cost-effective solution without compromising on legal validity.

In conclusion, a free printable personal loan agreement is a valuable tool for anyone borrowing or lending money. By using a customizable template, you can create a legally binding agreement that protects both parties and ensures clarity and transparency throughout the loan process.