When it comes to borrowing or lending money, having a written agreement in place is essential to protect both parties involved. A loan agreement outlines the terms and conditions of the loan, including the amount borrowed, the interest rate, and the repayment schedule. While you can hire a lawyer to draft a loan agreement for you, there are also free printable templates available online that can help you create a legally binding document without the high cost.

Printable free loan agreement templates are a convenient and cost-effective way to ensure that all parties are on the same page when it comes to borrowing and lending money. These templates can be easily customized to suit your specific needs and can be used for personal loans, business loans, or any other type of financial transaction that requires a formal agreement.

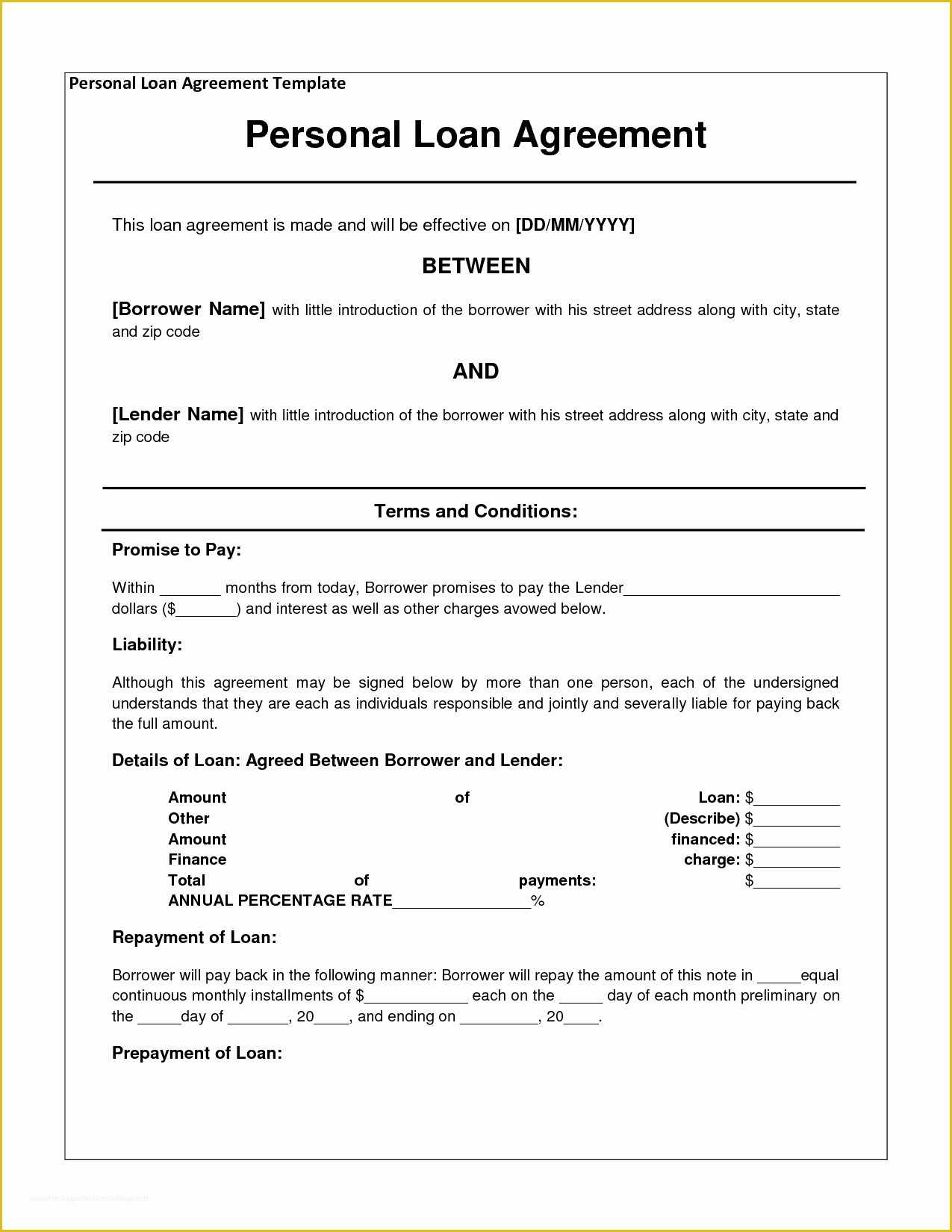

Printable Free Loan Agreement Template

Printable Free Loan Agreement Template

One of the key advantages of using a printable free loan agreement template is that it offers a clear and concise outline of the terms and conditions of the loan. This can help prevent misunderstandings or disputes down the line and can provide a sense of security for both the borrower and the lender. Additionally, these templates are typically easy to use and can be completed in a matter of minutes, saving you time and hassle.

It’s important to note that while printable free loan agreement templates can be a useful tool, it’s always a good idea to have any legal document reviewed by a lawyer to ensure that it complies with state and federal laws. This extra step can provide an added layer of protection and peace of mind for all parties involved in the loan agreement.

In conclusion, a printable free loan agreement template can be a valuable resource for anyone looking to formalize a financial transaction. By using a template, you can save time and money while still creating a legally binding document that outlines the terms and conditions of the loan. Whether you’re lending money to a friend or family member or borrowing funds for a business venture, having a written agreement in place can help protect both parties and ensure a smooth and transparent transaction.