A loan agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It is important to have a written agreement in place to protect both parties in case of any disputes or misunderstandings. A simple loan agreement is a basic document that sets out the key terms of the loan, such as the amount borrowed, the interest rate, and the repayment schedule.

Creating a loan agreement from scratch can be time-consuming and complicated. That’s why using a printable simple loan agreement template can make the process much easier. With a template, you can simply fill in the blanks with the relevant information and customize it to suit your specific needs.

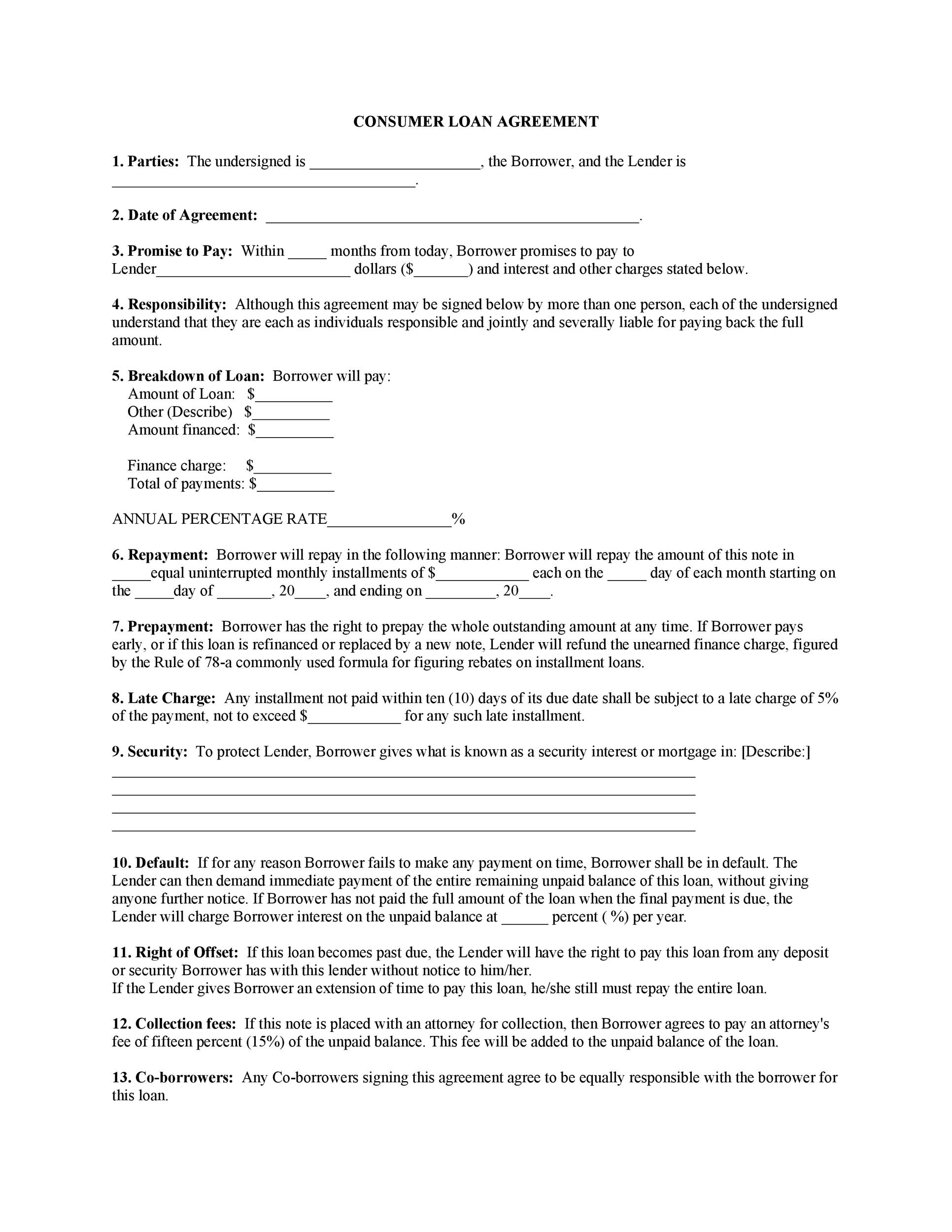

Printable Simple Loan Agreement

Printable Simple Loan Agreement

When drafting a simple loan agreement, it is important to include the following key elements:

- Names and contact information of both parties

- Loan amount and interest rate

- Repayment schedule

- Collateral (if applicable)

- Signatures of both parties

It is also a good idea to include any additional terms or conditions that both parties agree to, such as late payment fees or early repayment options. Having a clear and comprehensive loan agreement can help prevent any misunderstandings or disagreements down the line.

Once the loan agreement is drafted and signed by both parties, each party should keep a copy for their records. It is also a good practice to have a witness present when signing the agreement to validate the document.

In conclusion, a printable simple loan agreement is a valuable tool for both lenders and borrowers to formalize their loan arrangement. By using a template, you can easily create a customized agreement that meets your specific needs and helps protect your interests. Having a written agreement in place can provide peace of mind and clarity for all parties involved.